Ken and Barbara Rudzewick: A Maspeth love story

By Jessica Meditz

Ken and Barbara Rudzewick tied the knot on Oct. 6, 1962 at St. Stanislaus Kostka Church.

“It’s not just mortgages and money, it’s romance as well,” Kenneth Rudzewick said with a smile as he reminisced on the place where he met his soulmate, Barbara.

The Rudzewicks, known lovingly by many in the community as Maspeth’s power couple, or Mr. and Mrs. Maspeth, properly met in 1958 while working at Maspeth Federal Savings Bank.

Ken, 85, met then-Barbara Cheperak, 82, at the bank when he was 20 and she was 17. Because they’re both Maspeth natives and had mutual friends, they knew of each other, but never made that personal connection.

Ken feels it was fate that brought him to his wife.

“I was playing football at the time, the team was having a dance and I needed a date. I wasn’t going to meet anybody at the dance, and I didn’t have a steady girlfriend,” he explained. “But then I said to myself, ‘There’s a cute girl that works at the bank and she lives two blocks away,’ and I asked Barbara to join me. She did, and the rest is history.”

Ken worked at Maspeth Federal during its humble beginnings when it only had 15 employees, and the company has since grown to 144. The Rudzewick family legacy began at the bank in 1999, when Ken was elected president and CEO.

Barbara attended nursing school and worked as a nurse for 25 years at NewYork-Presbyterian Queens located in Flushing, which was known as Booth Memorial Hospital at the time.

The dynamic duo went on to tie the knot on Oct. 6, 1962 at St. Stanislaus Kostka Church, where Ken attended grammar school and where they sent their children.

Photographs from the day are enough to evoke a nostalgic feeling – even for those who did not live through the era – as seen through the glamorous mod bridal cap Barbara sported.

“Our reception was at Antun’s in Queens Village, which is still there,” Barbara said. “I still have my wedding gown; I had it preserved.”

They celebrated their 60th wedding anniversary this past October with their family and friends at West Side Tennis Club in Forest Hills.

Ken and Barbara had four children: Thomas, Jill (who passed away in 2012 due to breast cancer), Glenn and Roger.

They have nine grandchildren: Nicholas, 27; Kristian, 22; Emily, 20; Katie, 17; Meghan, 16; James, 14; Matthew, 13; Brendan, 12; and Ryan, 8.

The couple has been on numerous adventures together, traveling as far as Venice, Italy, as well as nearby destinations including Fire Island on Long Island.

The Rudzewicks in Venice, Italy.

Referring to the latter, Barbara said jokingly, “He nearly got me killed that day…we picked up rowboats and Ken had a cooler. The waves were extremely treacherous…I’ll never forget. But it was fun, we made it and we did it together.”

Many of their fondest memories and achievements happened right here in their hometown of Maspeth.

The Rudzewicks can be spotted at most community events, from street co-namings to Maspeth Federal’s annual summer concerts.

In fact, Ken came up with the idea to hold the summer concerts in the bank’s parking lot over 50 years ago, and casually informed his wife about it before a morning stroll.

“I told him, ‘Go ahead, go,’” Barbara said. “I thought he was crazy.”

The tradition’s been alive for 55 years. Another quintessential Maspeth event that the Rudzewicks are involved in is the annual Memorial Day Parade down Grand Avenue, an annual tradition since 1975.

Ken and Barbara also feel it’s important to fulfill their civic responsibilities through groups such as the St. Stanislaus Kostka Educational Endowment Committee, the Maspeth Kiwanis and the Kowalinski Post.

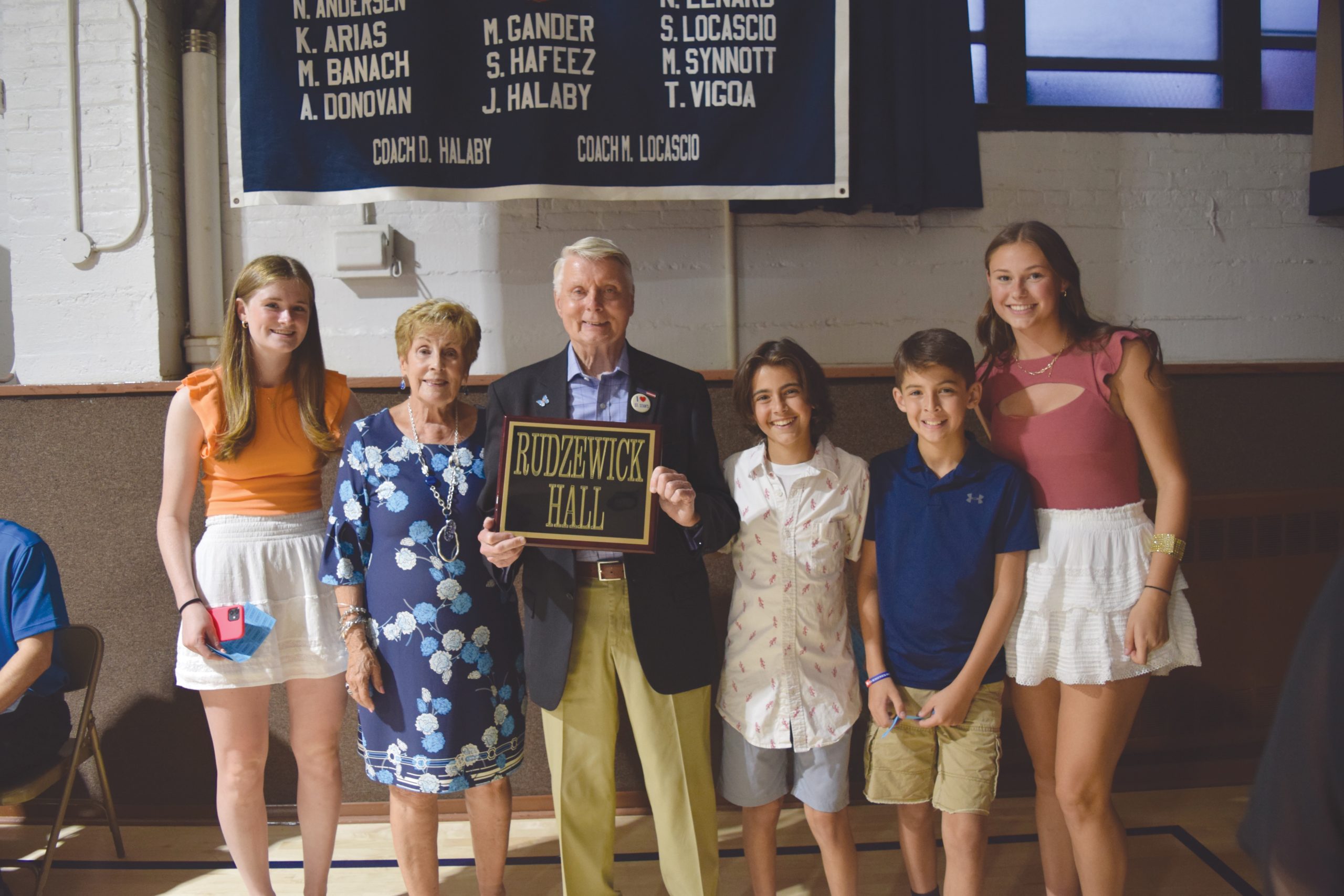

At last year’s 11th annual Hall of Fame Dinner Dance at St. Stan’s, the couple was completely surprised when the announcement was made that the school gym would be rededicated “Rudzewick Hall.”

The gym of St. Stan’s was renamed “Rudzewick Hall” in their honor.

“That was so special. I was absolutely overwhelmed, but so honored,” Barbara said.

“And they spelled our name right,” Ken added with a chuckle.

The Endowment Committee has raised over $380,000 for the school, going toward a STEM lab, scholarships, computers, Smart Boards, upgrades to the school’s electrical service, as well as school summer programs, and the Rudzewicks are proud to play a role in that.

Ken and Barbara attribute their success as a family and couple to the community of Maspeth – being they’ve lived here their entire lives.

They feel the tight-knit neighborhood has allowed them to dedicate themselves to their children and spend quality time with friends and family.

As for their secret to a healthy and happy 60-year marriage, Ken said that luck certainly is a factor, but shared some words of wisdom.

“Never give up on your mate, no matter what happens. It works, if you can do it. It’s not easy – there’s lots of bumps in the road – handle them as they come along,” he said. “And don’t take yourself too seriously…I think a lot of people do. That ruins a relationship. If you lose your sense of humor, it’s all over; that’s why God gave it to us. He knew we’d have to laugh through these things.”

They will continue to laugh together for the rest of their lives – no matter how old the “Ken and Barbie” jokes may get.